In an era when renewable energy has gone from a buzzword to a solid, profitable investment, eco-conscious households should consider installing solar panels. The government’s commitment to renewable energy is shown by the federal solar tax credit’s 26% deduction on solar installations. As our environmental narrative enters a turning point, solar power’s sustainability becomes more important. Reviews of solar companies help discriminating buyers find reliable installations that optimize environmental impact and economic benefits in this bright landscape. With climate issues and legislative backing rising, solar adoption is more appealing than ever.

What Is The Federal Solar Tax Credit?

The Federal Solar Tax Credit, or the Investment Tax Credit (ITC), represents a pivotal financial incentive within the solar energy sphere, originating from the Energy Policy Act of 2005. Initially, this policy enabled homeowners and businesses to deduct 30% of the cost of installing a solar energy system from their federal taxes. This measure has profoundly catalyzed the adoption of solar technology across the United States.

Eligibility For The Federal Solar Tax Credit

Who Can Apply?

Surging through the intricate webs of renewable incentives, the Federal Solar Tax Credit (ITC) is a glittering pecuniary promise for homeowners, business entities, and non-profit organizations blazing the trail toward solar adoption. Homeowners can harness this 26% tax credit on the solar system’s total cost, including installation. This sun-kissed deduction isn’t just a photovoltaic privilege but also extends to businesses, big and small, slicing through taxable income with precision. Meanwhile, although inherently exempt from taxes, non-profit organizations can leverage third-party solar arrangements or explore state-specific incentives that mimic the financial effect of the ITC. The regulatory landscape shines a focused ray of hope, particular to each type of entity, each one a solar protagonist in the collective saga of clean energy transition.

Types Of Solar Energy Systems Covered

When navigating the labyrinthine pathways of the Federal Solar Tax Credit, prospective clean energy lovers will find a welcome financial solstice: an array of solar energy systems is enshrined within the incentive’s embrace:

- Photovoltaic systems, the stalwarts of solar generation, sit squarely in eligibility’s spotlight — allowing homeowners to defray a substantial portion of installation costs via tax deductions.

- Solar water heaters, which must procure at least half of their energy from the sun, bask in the warmth of similar fiscal benefits as long as they serve the domicile and not a heated pool or hot tub — federal guidelines are clear on that exclusion.

- Energy storage devices, the unsung heroes of energy independence, catapult into relevancy as they’ve been recently annexed into the tax credit’s coverage.

How The Federal Solar Tax Credit Works

As of the dynamic Inflation Reduction Act, solar adopters can bask in a generous 30% tax credit for systems installed between 2022 and 2032. The credit’s glow diminishes, but only slightly, decreasing to 26% in 2033 and 22% in 2034. To illustrate, if you invest $20,000 in solar panels, the ITC grants you a $6,000 reduction on your federal taxes, not as a deduction but a veritable credit, a one-to-one dollar reduction in your tax bill. Here’s a brief overview of how it works:

- Eligibility: The ITC is available to homeowners and businesses installing solar photovoltaic (PV) systems. This includes the purchase and installation of solar panels and related equipment.

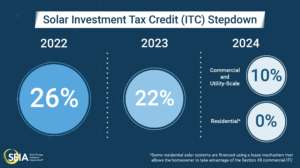

- Credit Amount: The ITC allows you to deduct a certain percentage of the cost of installing a solar PV system from your federal taxes. As of my last update in April 2023, the ITC provided a 26% tax credit for solar systems installed in 2020-2022 and was scheduled to decrease to 22% for systems installed in 2023 before expiring in 2024 for residential installations. However, these rates and timelines can change due to new legislation, so it’s important to check the current status.

- No Cap on Value: There’s no cap on the value of the ITC. Whether your system costs $10,000 or $100,000, you can claim 26% (or the current rate) of that cost as a credit.

- Rollover: If you don’t owe enough taxes in the year you install your solar system to claim the entire credit, you can ‘roll over’ the remaining credits to the following year.

- System Ownership: To qualify for the ITC, you must own, rather than lease, your solar energy system. Leased systems are typically ineligible for the homeowner to claim the ITC.

- Expiration and Phasing Out: The ITC is set to phase out over several years, with the credit amount reducing yearly until it expires. However, legislative changes can extend or modify these deadlines.

- Claiming the Credit: To claim the ITC, you’ll need to complete IRS Form 5695 as part of your tax return. Calculate the credit on this form and then add the result to your Form 1040.

- State and Local Benefits: In addition to the federal ITC, some states and local governments offer additional incentives for solar energy, which can provide further financial benefits.

Additional Incentives And Rebates

State Solar Incentives

Navigating the labyrinth of state tax credits can be akin to discovering hidden treasures in the complex world of solar investments. Many states tantalize homeowners with tantalizing tax credits, offering a percentage back from the total solar installation cost, effectively slicing through the financial barrier to entry. On the federal front, government rebates serve as an alluring incentive, bolstering the adoption of solar with programs like the Investment Tax Credit (ITC), which promises a hearty 26% deduction on solar systems through 2022 before it declines.

Adding yet another layer to this solar incentive cake are Solar Renewable Energy Certificates (SRECs). These certificates are a brilliant demonstration of green economics in action. In states that have a Renewable Portfolio Standard (RPS) with a solar carve-out, SRECs function as an open market system, allowing homeowners to sell energy credits accrued through solar production to utility companies scrambling to meet clean energy quotas — turning rooftops into revenue streams that gleam almost as brightly as the solar panels themselves. Each state’s embrace of SRECs varies, with states like New Jersey and Massachusetts heralding some of the most dynamic markets that benefit consumers with competitive pricing structures and bolster the integrity of nationwide clean energy initiatives.

Local Utility Rebates and Subsidized Loans

Navigating through the entangled web of local utility rebates for solar installation can be as tantalizingly complex as the electrical circuitry of the photovoltaic cells themselves, yet the financial rewards shimmer like sunlight on a solar panel. Utilities, often fueled by state mandates, dangle rebates like cosmic carrots, enticing homeowners towards clean energy transformation. These rebates, a patchwork quilt varying by region, can slash capital costs, with some locales offering to reimburse a percentage per watt of installed capacity, imprinting a significant reduction on the initial investment.

Tax Exemptions

On the sales tax front, several states have crafted exemptions that provide immediate relief at the point of purchase, slicing the upfront costs and making solar panels more accessible. For example, in a sunbathed state like Florida, the Solar and CHP Sales Tax Exemption permits residents to forgo the 6% sales tax, savings that can translate to a considerable dollar amount shaved off the total solar installation cost. These incentives amplify solar attractiveness, deftly reduce the economic barriers to clean energy adoption, and accelerate the shift towards a more sustainable energy portfolio.

Advanced Considerations

The Future of Solar Tax Credits

In the ever-pulsating heart of the solar landscape, the horizon beyond 2024 brims with electric potential as the fate of solar tax credits teeters on the whims of policy pendulums. Analysts predict that a legislative renaissance may kindle new financial sparks while the sun sets on the existing Investment Tax Credit (ITC).

As governments globally entwine their fates with the clean energy crusade, the United States, too, under the luminescence of its commitment to renewable energy, may unfurl fresher, more robust incentives. With states like California already legislating solar mandates for new homes, there’s a crescendoing anticipation that federal incentives will pivot to support solar adoption and storage and integration into a smart grid. These futuristic vistas are not just idle chatter but a beacon for the strategic homeowner and savvy installer, signaling an era where solar ownership aligns with smart economics and climate stewardship. Thus, navigating the post-2024 landscape mandates an eagle eye on Capitol Hill’s oscillating currents and a readiness to harness the gales of change.

Comparing Solar Tax Credits with Other Energy Credits

The labyrinthine corridors of renewable energy tax incentives can be as dizzying as a gust through a wind farm. Yet, the distinctions between solar and other energy credits are crucial to unraveling the fiscal threads of green investment. For example, the Investment Tax Credit (ITC), which currently benefits solar aficionados, shaving off a prodigious 26% of the installation cost through 2022 before it steps down to an eventual 22% in 2023. Meanwhile, wind energy projects that began construction in recent years grip tightly to a Production Tax Credit (PTC) or elect the ITC — though the PTC is set to breeze into the sunset at the end of 2021 unless reanimated by new legislation.

Juxtapose these with geothermal power, where projects that engage the Earth’s underground sauna before January 2024 can bask in a 10% ITC. This figure steadfastly endures despite the ebb and flow of its wind and solar cousins. The geothermal credit, rich with underground potential, offers a stable thermal handshake, contrasting the solar ITC’s decline and wind’s vanishing act. Each state further juggles its intricate policies; for instance, California’s SGIP (Self-Generation Incentive Program) provides a golden financial carrot for solar battery storage, underlining the state’s solar-geared energy strategy, while other states may herald geothermal systems with more enthusiasm. Thus, the fiscal alchemy of turning renewable tech into gold is as much a matter of timing as geographic acumen.

Conclusion

In the illuminating exploration of fiscal incentives within the renewable landscape, “Tax Breaks and Beyond: How Installing Solar Panels Can Pay Off” showcases the pivotal role of solar tax credits as catalysts for clean energy transitions. State-specific legislation, such as the Investment Tax Credit (ITC), not only lightens the financial burden for eco-conscious consumers but also turbocharges the solar industry’s growth, contributing to job creation and sustainable development. The article underlines their critical contribution to making solar installations an increasingly attractive investment by delving into the nuances of these state-enforced tax incentives. The piece also spotlights contemporary data, underscoring the uptrend in homeowners harnessing solar power to capitalize on these benefits, fueling an eco-friendly future and driving economic resilience in the vibrant renewable energy sector.

FAQ

What kind of tax credits can you get from a solar installation?

In the United States, homeowners and businesses can capitalize on the federal Investment Tax Credit (ITC) for solar installations, which provides a 26% tax credit for systems installed by December 31, 2022, and 22% for systems installed in 2023. It drops to 10% for commercial projects and expires for residential solar installations from 2024. Unlike deductions, this credit offsets taxes dollar-for-dollar. Some states offer additional incentives, like local tax credits, rebates, or Solar Renewable Energy Certificates (SRECs), further reducing the net cost. These incentives vary by location, augmenting the federal ITC benefits, and serve as a dynamic tool to encourage solar adoption and investment within specific regions.

How do solar tax credits work?

Solar tax credits, like the federal Investment Tax Credit (ITC), allow you to deduct a percentage of your solar installation costs from your federal taxes. Eligible homeowners or businesses can calculate the credit based on the total cost of their solar project. Claim by submitting the credit amount on your tax return.

What are the tax benefits of establishing a solar plant?

The Investment Tax Credit (ITC) offers a significant 26% deduction off solar installation costs from federal taxes, shining above others like wind (ITC up to 22%) or geothermal. While some renewables may offer production-based incentives, solar’s upfront benefit aligns sublime with an investor-focused ethos, elevating its financial lure.