Freon, a term commonly used to refer to a group of chlorofluorocarbons (CFCs) used in air conditioning and refrigeration, has been a topic of discussion not just for its applications but also…

Continue ReadingThe hummingbird, a mesmerizing gem of the avian world, is renowned for…

In the tapestry of American state symbols, each state’s choice of a…

The use of essential oils like eucalyptus has gained popularity in recent…

The use of charcoal has been a fundamental part of human history,…

News

Underwater welding is a critical yet perilous profession that plays…

Diving into the intriguing world of underwater welding not only…

Georgia’s minimum wage law is one of the lowest in…

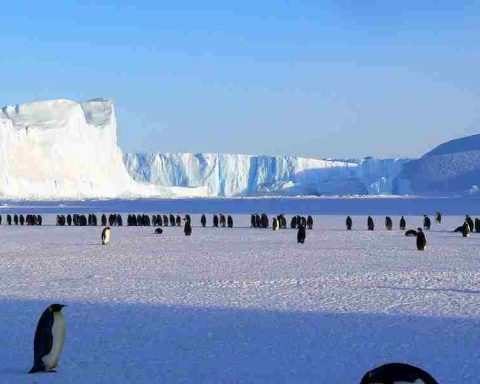

Antarctica is a continent shrouded in mystery and wonder. It…

World

Underwater welding is a critical yet perilous profession that plays a pivotal role in maintaining and repairing structures beneath the ocean’s surface.…

Diving into the intriguing world of underwater welding not only requires nerves of steel but also a keen interest in the financial…

Georgia’s minimum wage law is one of the lowest in the nation, and it’s had a profound effect on the lives of…

Antarctica is a continent shrouded in mystery and wonder. It is the coldest and driest place on Earth, with temperatures rarely climbing…

Politics

Being a lawyer requires a high level of trustworthiness and integrity. After all, lawyers are tasked with representing their client’s best interests,…

MoreLooking for a way to make your dress fit perfectly? It’s easy to get overwhelmed when trying to figure out how to…

MoreIn the 1980s, people talked of a “second American Revolution” that would reverse the decay, intolerance, and social fragmentation of the 1970s.…

MoreWhen the Senate votes on legislation, whether it’s a bill that has just been introduced or one that has already been passed…

MoreAnyone who has had to make a bail payment can tell you that it’s not cheap. Even if someone is only being…

MoreSnow cars are a staple in the winter driving experience, but they have a lot more going for them than just being…

MoreDo you need to provide reinforcement with a rebar? Or, can you just pour the cement and be done with it? Well,…

MoreWhen you think of a “tongue,” what comes to mind? Most likely words, at least the English-speaking variety. However, your tongue is…

MoreThe way a razor cuts your skin is as important as how it does it. The wrong razor can give you a…

MoreWhen you first think about putting up shelves, you probably imagine using nails to attach them to the wall. You might even…

MoreDo you have that one odd T-shirt in your collection that you swear no one else has? The T-shirt with the strange…

MoreWhat’s the deal with your turtle not eating? It’s happened to almost everyone. You go to put some food in his tank…

MorePopular Post

About US

Read More

Business

The main task of customization is to make the brand better and as user-friendly as possible for the consumer, taking into account their individual requirements and preferences. In fact, customization is not…

The cost elements of HVAC ductwork installation are critical to homeowners and business owners as they embark on the process of installing the ductwork. The whole process, from hiring a ductwork professional…

Over-the-road (OTR) fleets play a crucial role in the transportation industry, delivering goods across vast distances efficiently. However, navigating efficiency challenges is essential for fleet managers to ensure smooth operations, minimize costs,…

Edmonton, a thriving city in Alberta, Canada, offers many opportunities for commercial real estate development. Investing in Edmonton’s commercial land can be a great opportunity if you know how to plan and…

Are you a personal injury lawyer looking for fresh marketing ideas to grow your law firm? Well, if so, then you are in the right place. In this write-up, we’ll guide you…

Travel

Travelling with kids can be a bit of a nightmare to say the least, especially if yours are of a young age.…

MoreIn the bustling world of travel, Global Entry stands out as more than just a shortcut through airport security. It’s a trusted…

MoreMore and more people prefer to refuse package tours and travel on their own – it’s understandable, it’s nice to feel that…

More